Harshad Mehta Bull Run rajkotupdates.news

Harshad mehta bull run rajkotupdates news : The financial world is rife with stories that capture the imagination, and one such story is the Harshad Mehta Bull Run. This captivating tale of a stock market tycoon’s meteoric rise and subsequent fall has left an indelible mark on India’s financial landscape. In this article, we delve into the intricacies of the Harshad Mehta Bull Run, its impact, and the lessons it has left in its wake.

Also read : https://myfeednews.com/dan-mintz-and-valiant/

Introduction: The Harshad Mehta Bull Run Unveiled

The Harshad Mehta Bull Run, a term synonymous with the stock market boom of the early 1990s, was a period of unprecedented optimism and exuberance. Harshad mehta bull run rajkotupdates news :Harshad Mehta, a stockbroker from Mumbai, orchestrated a colossal surge in stock prices, fundamentally altering the dynamics of the Indian stock market.

The Rise of Harshad Mehta: A Stock Market Maverick

Harshad Mehta’s journey from a humble background to the pinnacle of the financial world was nothing short of remarkable. His audacious trading strategies and charismatic persona earned him the moniker “Big Bull.” Mehta’s ability to manipulate the market and engineer significant upswings in stock prices was unparalleled.

The Mechanism Behind the Bull Run

At the heart of the Harshad Mehta Bull Run was a complex mechanism known as the “Ready Forward” scam. Mehta exploited the banking system’s loopholes to inflate stock prices artificially, using funds borrowed from banks. This injection of liquidity into the market created a cascading effect that led to soaring stock prices.

The Stock Market’s Exuberant Rally: Unraveling the Phases

The Bull Run unfolded in distinct phases – from the initial triggers that set it in motion to the gradual realization that the market was being manipulated. Harshad mehta bull run rajkotupdates news : The stock prices of even fundamentally weak companies experienced unprecedented surges, baffling experts and investors alike.

The Fall from Grace: Harshad Mehta’s Downfall

As the adage goes, all good things must come to an end. Mehta’s empire of deceit eventually crumbled, triggering a catastrophic market crash. Harshad mehta bull run rajkotupdates news :The revelation of the fraudulent activities and the subsequent legal battles led to Mehta’s downfall and tarnished his once-glorified image.

Regulatory Repercussions: Overhauling the Financial System

The Harshad Mehta saga prompted a reckoning within India’s financial regulatory framework. Reforms were introduced to tighten oversight, enhance transparency, and prevent such scams from recurring. The Securities and Exchange Board of India (SEBI) emerged stronger, equipped with more stringent regulations.

Lessons Learned: Market Manipulation and Investor Awareness

The Harshad Mehta Bull Run underscores the dangers of unchecked market manipulation. Investors learned the importance of due diligence, skepticism, and the need to question extraordinary market movements. This era served as a wake-up call, fostering a sense of vigilance among investors.

Impact on the Indian Financial Ecosystem

The reverberations of the Harshad Mehta Bull Run were felt across the Indian financial ecosystem. Public trust in financial institutions eroded, and the stock market’s credibility took a hit. The episode highlighted the need for ethical practices and ethical conduct in the financial industry.

Unveiling Scams: The Aftermath of the Mehta Scandal

The Harshad Mehta episode paved the way for uncovering other financial irregularities. Scams like the Ketan Parekh scandal echoed the patterns Harshad mehta bull run rajkotupdates news :established during the Bull Run, further emphasizing the importance of systemic checks and balances.

The Legacy of Harshad Mehta: A Cautionary Tale

Harshad Mehta’s legacy is a cautionary tale about the perils of unchecked ambition and market manipulation. His rise and fall serve as a reminder that even the most formidable can stumble when they stray from ethical practices and regulatory compliance.

Reforms and Resilience: Strengthening the Market System

The Indian stock market emerged from the Harshad mehta bull run rajkotupdates news : Harshad Mehta episode with newfound resilience. Reforms aimed at fortifying the system against fraudulent activities were implemented, contributing to the development of a more mature and stable market environment.

The Harshad Mehta Effect: Shaping Financial Journalism

The media played a pivotal role in unraveling the Harshad Mehta saga. Investigative journalism exposed the intricate details of the scam, prompting a reevaluation of the relationship between the media and financial markets.

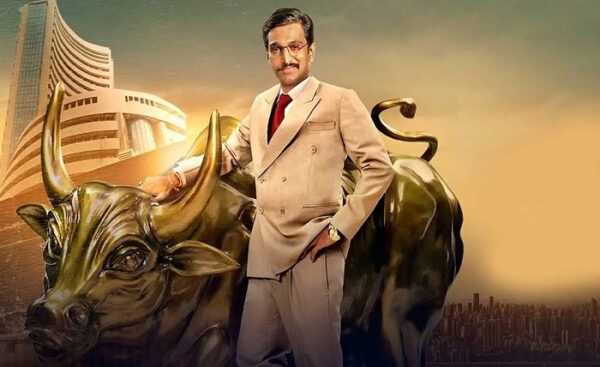

Fictional Depictions: Mehta’s Story on the Silver Screen

The allure of the Harshad Mehta Bull Run extended to the world of entertainment, inspiring movies and web series. These fictional adaptations brought the story to a broader audience, immortalizing Mehta’s saga in popular culture.

Navigating Volatile Markets: Investor Tips

In the wake of the Harshad Mehta episode, investors learned valuable lessons about navigating volatile markets. Diversification, staying informed, Harshad mehta bull run rajkotupdates news : and maintaining a long-term perspective are some of the strategies that can help investors weather market uncertainties.

Conclusion

rajkotupdates news : The Harshad Mehta Bull Run remains a watershed moment in India’s financial history. It served as a crucible that reshaped regulations, investor attitudes, and market dynamics. While the era was marked by deceit and manipulation, it also spurred growth, resilience, and a renewed commitment to transparency.

FAQs

-

What was the Harshad Mehta Bull Run?

- The Harshad Mehta Bull Run refers to a period in the early 1990s when stockbroker Harshad Mehta orchestrated a massive surge in stock prices through market manipulation.

-

What led to Harshad Mehta’s downfall?

- Harshad Mehta’s downfall was triggered by the exposure of his fraudulent trading practices and the subsequent legal actions against him.

-

How did the Harshad Mehta episode impact the Indian financial system?

- The episode prompted significant regulatory reforms and led to a heightened awareness of the dangers of market manipulation.

-

What lessons can investors learn from the Harshad Mehta Bull Run?

- Investors can learn the importance of due diligence, skepticism, and ethical investing practices to avoid falling prey to market manipulation.

-

What is the legacy of the Harshad Mehta Bull Run?

-

The legacy includes reforms that fortified the financial system, a renewed focus on transparency, and the portrayal of Mehta’s story in various forms of media.